Do I need Estate Planning?

- By 7051980283

- •

- 16 Nov, 2021

- •

What are the life events when you need estate planning?

These are some of the major life events when you should to speak to a trusts and estates attorney, to determine your needs.

· Reaching age 18 – This is a time to do advanced directives for Healthcare (“Living Wills”) – before age 18 your parents or guardian can handle healthcare decisions for you as a minor; once you have reached majority you need to appoint someone to handle these decisions if you are not able to, due to temporary or permanent disability (illness, accident). For a disabled adult who is mentally unable to handle their own affairs, this is a time to for family members to apply for Guardianship (a little before the 18th birthday is best) so they can go on caring for an adult child after 18.

· Marriage – Powers of Attorney (“POAs”), Living Wills, Wills – Some people assume that getting married automatically gives the spouse certain roles, but there is no automatic appointment of a spouse to any of these roles for the other spouse: to handle legal affairs if the other spouse is unavailable, to handle healthcare decisions if the other spouse is incapacitated, or to administer the estate of a deceased spouse.

· Cohabitation in a committed relationship – POAs, Living Wills, Wills – Lots of people don’t get married these days, but may have long-term committed relationships. The need is still there to have someone help with legal affairs, healthcare decisions, or administering an estate, for a life partner who is incapacitated or who dies. Properly drafted POAs, Living Wills, and Wills can provide unmarried partners with many of the same protections available to married partners.

· Purchase of first home or acquiring any other significant asset – POAs, Wills.

· Birth of a child, pregnancy – Wills to provide for guardianship of your child, Living Will in case of childbirth complications.

· Divorce – POAs, Wills, Living Wills – While some inheritance rights of a spouse are cut off when a divorce is filed, it’s important not to inadvertently leave an ex (or soon-to-be-ex) in charge of things when you are divorcing.

· Birth of grandchildren – re-examine Wills.

· Age 65 – 70 – Elder-care planning – will you have sufficient assets to cover your long-term care if you it? Will you need to qualify for public benefits?

· Death of a close family member – Estate administration, POA, Living Wills for a surviving spouse – if the spouse is named as POA, estate executor, or healthcare representative, and that spouse dies, the secondary POA, executor or representative may need to act if the surviving spouse is not up to it for any reason. New documents may be needed, or court actions may need to be filed, to appoint someone appropriate to these roles.

(c) C. Megan Oltman, Esq. 11/16/2021 image (c) Vanity Studios

Please note that blog posts do not constitute legal advice, but are intended for informational purposes only. They cannot substitute for an in-person consultation with a lawyer. Your use of this site does not create an attorney client relationship.

Money: attitudes towards money, disagreements over

lifestyle, spending, and debt; is one of the top three biggest issues leading

to divorce.

My mother died at age 88, my dad four years

earlier age 84. When Dad died they had been married 64 years, since she was 19

and he was 20. My sister said, while we were going through Mom’s jewelry after

her death, “oh, look, those are the pearls that almost ended their marriage.”

We’re living in scary times, with a global pandemic doubling (or more) the number of deaths we would see in an ordinary year, and some people who catch the coronavirus and recover ending up with life-changing lung or heart conditions. Though it is uncomfortable to face these issues, this is a good time to do your estate planning. For most people, an estate plan will include:

· a Living Will – to appoint someone to make healthcare decisions for you, and give some guidance as to what you want to happen if you are critically ill;

· a Last Will and Testament – to appoint an Executor to handle your estate, and direct who should receive your assets, and appoint a Guardian if you have minor children; and

· a Power of Attorney – to appoint someone to handle your legal affairs for you if you are alive but incapacitated and unable to act for yourself.

Many people are uncomfortable thinking about these issues, and tend to put them off. “There’s no time like the present” is a well-used saying, but maybe more true now, than ever. There is no time like this present, and we hope devoutly this time will pass and not return. But uncomfortable though it may be, creating these documents is a gift you give to your loved ones, to give them some guidance in an emergency.

Wills are very important, but I want to talk more about Living Wills and Powers of Attorney at this time. Anyone over 18 can, and I will say should, have a Living Will and Power of Attorney. If I am unconscious, or otherwise unable to speak or act, I want to make sure someone has the ability to convey my wishes to my healthcare team, and the authority to see those wishes carried out. If I can’t handle my own affairs, pay bills, sign legal documents, I want to know someone is taking care of those issues for me. Without a Living Will and Power of Attorney, my loved ones would have to ask the court to grant them authority, which would be time-consuming, uncertain, and likely expensive.

In the face of the pandemic, I have had college students who worked with me to create Living Wills so their parents could act for them if they become ill. Personally, having now lived through the deaths of all my grandparents, my in-laws and my parents, I know how much difference it makes to give the relatives a road-map. The first of my grandparents to die, died in the 1980’s before Living Wills were a common thing. He was in a coma for over a week, with agonizing decisions needing to be made by the family throughout that time. No one needs that added burden, on top of the grief they will be feeling.

Please reach out if we can help you take care of your planning.

(c) C. Megan Oltman, Esq. 10/18/2020

Please note that blog posts do not constitute legal advice, but are intended for informational purposes only. They cannot substitute for an in-person consultation with a lawyer. Your use of this site does not create an attorney client relationship.

(c) C. Megan Oltman, Esq. 5/20/2020

Please note that blog posts do not constitute legal advice, but are intended for informational purposes only. They cannot substitute for an in-person consultation with a lawyer. Your use of this site does not create an attorney client relationship.

Let’s face it, there is no really easy way to divorce. It will be an emotional experience even for couples who are determined to remain friends and settle things in an amicable fashion. Sadness, grief, frustration, and anger are common experiences while going through this transition. When a marriage ends, it is the end of an era in your life, a death of many aspects of a relationship, of a shared vision and hope. Facing that end will have both partners going through a grieving process, though each may very well be at different stages in that process at any given time.

When a couple mediates a divorce settlement, they are working with an impartial third party who can facilitate their discussion to settle all the issues that need to be agreed upon – how property is to be divided, who will live where, whether either partner needs financial support from the other, if there are children, who will care for them, how much time each parent will spend with them, and how the children will be supported financially. Any one of these issues can raise fear for the future, fear of change, insecurity, anger, lack of trust, or resentment; all the specters of past arguments and disappointments.

If a couple is divorcing but using attorneys to do the negotiation, all these feelings will likely still arise, but there is a certain amount of insulation between each partner and the other. Over the long run, mediated agreements produce better outcomes, and fights in court are uglier and much more costly than the disagreements that come up in mediation. But in mediation the partners are committing to spending time together, with the mediator, and are courageously facing whatever feelings that brings up.

Now if you’re a former mediation client of mine, and you

think back on your mediation, courage may not be the word that comes to mind. But

I say you are courageous – I salute the courage of couples who choose to

mediate. It is the easier way to divorce because you can resolve all the issues

in a shorter time, with less expense, and with more flexible and creative

solutions available to you, than if you litigate. Mediation tends to produce

more lasting agreements, that the partners both feel some ownership in. But

even though it’s the easier way, it can also feel like the harder way, in the

moment, as you mediate and face everything that brings up. Easier, harder, and worth it.

(c) C. Megan Oltman, Esq. 10/22/19

Please note that blog posts do not constitute

legal advice, but are intended for informational purposes only. They cannot

substitute for an in-person consultation with a lawyer. Your use of this site

does not create an attorney client relationship.

© C. Megan Oltman, Esq. 9/11/19

Please note that blog posts do not constitute

legal advice, but are intended for informational purposes only. They cannot

substitute for an in-person consultation with a lawyer. Your use of this site

does not create an attorney client relationship.

Something weighing heavily on my mind lately is the fact that more than 75 percent of Millennial parents don’t have life insurance and that barely half of these have a will. As a now-single mother and widow, I found out the hard way why having a solid financial plan in place is crucial, regardless of age. Part of the healing process for us was to regain financial traction, but it was hard, and there were times when I was angry that it wasn’t taken care of before. I hope that the following advice will save someone else the heartache we endured.

For many parents, thinking about finances and saving money might induce stress and anxiety; it’s hard to think about the future when there are so many other important things happening in the present. Raising a child is a huge job, and for new parents , there are lots of details and new experiences that come along with it that override thoughts of money.

However, it’s important to start planning as early as possible for your financial comfort, as life will throw many curveballs your way over the years. From home maintenance to school expenses, there are many things that could drive up your debt and derail your savings plan.

Also, start thinking about a plan for your family after you’re gone. While no one wants to think about end-of-life preparations, doing so now will help your loved ones immeasurably in the event of your death, giving you peace of mind that they’ll be taken care of no matter what happens. Keep reading for some of the best tips on how to start stress-free financial planning.

Educate yourself

It can be difficult to know where to begin with planning if you’re unfamiliar with certain terms or the best way to save, so do some research. Talk to your bank about the best savings accounts for college and exactly what they entail. For instance, one plan may require that all the money in the account be used within a certain time frame, or that it only be used for college, meaning that if your child decides to travel the world instead, he can’t withdraw the money and use it to fund his trip. Getting educated about your finances will not only help you have a better understanding of how to prepare, but it will also help reduce your stress throughout the process.

Update your insurance

Being a new parent is scary because it’s so easy to think about all the things that could happen, from car accidents to illness. Updating your health and life insurance policies will ensure that your loved ones are taken care of no matter what happens, and you will be covered in the event of an accident or illness. During this time, you should also decide whether a pre-paid funeral plan is something worth looking into; considering that the average funeral in the US costs around $8,508 , taking care of this expense ahead of time will take some of the burdens off your family’s shoulders. Additionally, it’s also a good idea to look into creating a living will.

Calculate your worth

All good financial planning starts with a basic rule: Know your worth. Adding up all of your investments and assets will give you a good idea of where to begin when you start thinking about college funds and retirement, and since one of your biggest investments is your home, you’ll want to find out how much it’s worth.

Create a savings plan

Not only is it important to figure out how to save in the long-term--for college, for instance--it’s a good idea to start learning how to save money in the short-term and on a daily basis. You might start cooking more often than you eat out, carpool to save money on gas and supplement your income by selling gently used clothing and accessories on apps such as Vinted and Poshmark. While it may seem like these saving tactics aren’t doing much, they can help you save quite a bit of money if you stick with them.

Figuring out your finances and learning how to save will give you peace of mind, both now and later in life. With a good savings plan, you and your loved ones will feel secure and safe no matter what comes your way.

From time to time we will bring you guest posts on topics of interest.

Please note that blog posts do not constitute legal advice, but are intended for informational purposes only. They cannot substitute for an in-person consultation with a lawyer. Your use of this site does not create an attorney client relationship.

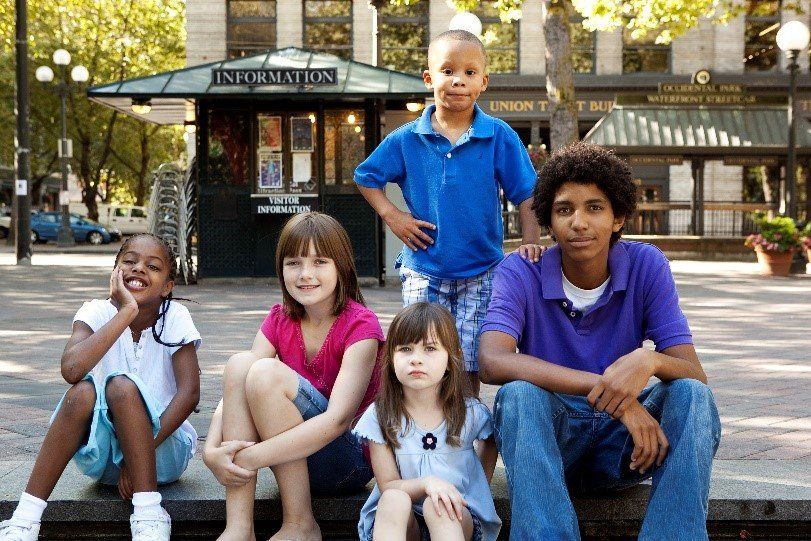

Abbey visited with the sisters every few weeks and worked with the foster parents and the child welfare agency to determine if there was a home that could accommodate both children. The sisters were eventually placed with their grandmother after receiving the necessary educational support services and occupational therapy that was so desperately needed.

CASA volunteers like Abbey help children like Lucy and her sister find stability, permanency and loving, stable homes. Since 2000, CASA of NJ, Inc. part of a national network of non-profit programs that advocate for children removed from their families because of abuse or neglect, has been successful in its mission.

CASA of NJ promotes and supports a statewide network of local CASA programs (Affiliates).CASA programs operate in all 21 counties in New Jersey. CASA Affiliates recruit and train community volunteers to be a "voice in court" for children. These advocates "speak up" for these children, helping them get the services they need and ensuring that they find safe, permanent homes. All that’s required to become a CASA volunteer is a bit of time and training to make a difference in the life of a child in foster care.

CASA volunteers visit the child approximately once a month. They work as facilitators to secure resources and services such as therapeutic evaluations for a child and family, tutoring services, educational resources, medical services, etc. CASA volunteers provide consistency and facilitate a strong foundation for a child’s growth and development. The CASA volunteer remains on the case until it is permanently resolved.

The CASA volunteer meets with the child, parents, family members, social workers, school officials, health providers and others who are knowledgeable about the child’s history. They also review all records pertaining to the child’s case including education and healthcare. Then the volunteer is able to prepare reports and make recommendations to the court on the child’s status and needs.

For additional information, and to find out the steps to become a CASA volunteer, visit: www.CASAforchildrenNJ.org , or contact Helen Davis, CASA Statewide Volunteer Sourcing Coordinator at hdavis@casaofnj.org - (973) 975-8050

"The Court Appointed Special Advocate (CASA) Programs have a record of public service protecting the safety and well-being of New Jersey's abused and neglected children, defending them from harm and ensuring that they are provided with the court-ordered services they need."

Philip D. Murphy, Governor of the State of New Jersey CASA Child Advocate Day Proclamation, April 6, 2018

Please note that blog posts do not constitute legal advice, but are intended for informational purposes only. They cannot substitute for an in-person consultation with a lawyer. Your use of this site does not create an attorney client relationship.

A Living Will, more formally known as a Health Care Proxy and Advanced Directives for Healthcare, is not actually a will at all. An actual will (“Last Will and Testament”) becomes effective when you die, and primarily gives your instructions as to what is to happen to your property after you die. A living will is used while you are still alive, and gives directions as to how (and by whom) you would like your medical care to be handled, if you are unable to make your own medical decisions, and what kinds of interventions, if any, you would want in an end-of-life situation.

All of which sounds rather grim, and not likely to be on the gift-wish list of young adults and their parents. From my own experience, having been through the deaths of 4 grandparents, two parents-in-law, and a parent, I feel that a living will is a gift that a person gives to their loved ones, who will have to make medical decisions for them if they are severely ill or injured. It can be devastating to operate without these kinds of instructions when you need to make life or death decisions for a loved one.

I find that people’s feelings about end of life decisions fall along a spectrum, from the “keep me alive if there’s any glimmer of hope” at one end, to the “aid me in having a peaceful and pain-free death” at the other.

Do we know how our loved ones feel about these issues, and what they would want to have happen in an end-of-life situation? What if a young adult, just turned 18, is in a catastrophic accident? Because an 18 year old has reached their majority, parents will not automatically be permitted to direct medical decisions if the young adult is unconscious or otherwise unable to make their own decisions. On the other hand, once a young adult turns 18, they might be called on to make medical decisions for their parents if the parents are unconscious or incapacitated. A living will prepares for these situations, and gives loved ones guidance in a moment of crisis. While I offer this advice with a heaping measure of “Gods and the fates forbid,” and hope no young adult or parents of a young adult will need to make use of a living will for many years to come, being prepared brings peace of mind.

Parents can give peace of mind to their young adults by making their own living wills, and young adults can give a gift peace of mind to their parents the same way. New graduation/coming of age gift idea? At Oltman Law & Mediation we are happy to help. Please give us a call at (609) 924-2044.

© C. Megan Oltman, Esq. 3/21/19

Please note that blog posts do not constitute legal advice, but are intended for informational purposes only. They cannot substitute for an in-person consultation with a lawyer. Your use of this site does not create an attorney client relationship.

Photo © 2010 by mighty mighty bigmac